Is Your Financial Advisor Worth It?

How Much Does Your Financial Advisor Really Cost?

Financial advisors can provide valuable guidance and support as you work towards your financial goals, but how much does investing with a financial advisor really cost? Figuring that out will help you answer the question, “Is your financial advisor worth it?”

I had a very hard time finding good material for this blog post. Why? Because so many articles do not include the all the costs you pay someone else to manage your investments.

Aside from investment management fees, you (the client) are also paying for the underlying expenses of the investments your advisor selects, financial planning fees if applicable, and platform fees of the brokerage firm where your investments are custodied.

The main source for all the data below is from Michael Kitces’ study in 2017. Michael is one of the most well-known financial bloggers in the industry with over 57k financial advisor subscribers. Again, I couldn’t find any more recent data on the subject, so we will have to work with his data. Note, however, that I did find another one of his articles in 2021, but his work in 2017 for financial advisors seems more comprehensive.

Investment Management Fees

Let’s first talk about the most obvious and usually the largest fee clients pay: investment management fees.

Source: Michael Kitces

As you can see in the graph above, the average client pays about 1% of the assets being managed by their financial advisor. From seeing what other advisors charge today, that remains relatively true.

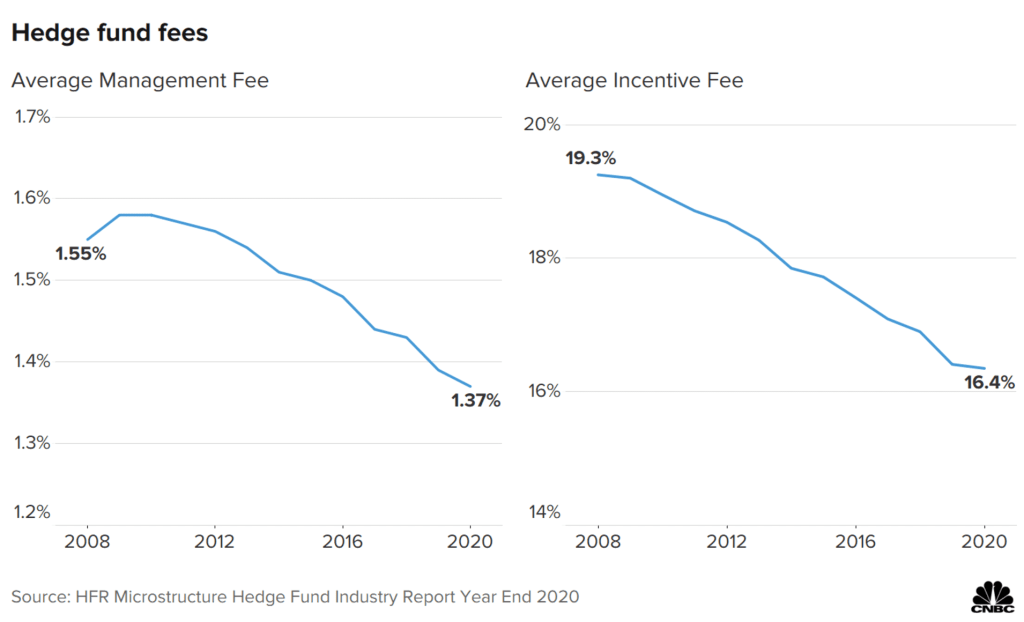

For high-net-worth individuals and institutions that hire hedge fund managers, their fees are even higher, even though their fees have declined over time.

Source: HFR via CNBC

As you can see above, hedge fund investors have to pay the managers 1.37% annually plus 16.4% of their profits.

Underlying Investment Expenses

Next, many potential clients aren’t aware of this fee. Most financial advisors invest their clients’ money using funds (or worse, insurance products such as annuities and non-term life insurance). Regardless whether advisors use mutual funds or exchange-traded funds (ETFs), those products have underlying expenses within them (see graph below). I have not yet seen an investment brokerage statement that clearly spells out the average expense ratio for the whole portfolio because most advisors don’t disclose expense ratios at all.

Source: Michael Kitces

Since the data above is from 2017, one could argue that these fees could have gone down a little bit, but again, I couldn’t find new data for the underlying investments that financial advisors use today.

When we combine the investment management fee of the financial advisor and the underlying fees of their investments, the cost looks more like this graph below.

Source: Michael Kitces

Financial Planning Fees

But that’s not all; some financial advisors also charge for financial planning work that they do. According to Michael, the average financial planning fee that financial advisors charge is 0.50%. I would note, however, that in my experience many financial advisors provide this service at no extra charge.

In a 2021 blog post, Michael shares data on what financial planners (their business model is different than financial advisors) charge for an initial financial plan.

Source: Michael Kitces

As you can see above, an initial financial plan will cost you thousands of dollars. This doesn’t count future fees to update the plan. From what I see today, some financial planners charge much higher prices than the median prices listed above.

Stock Trading Platform Fees

Finally, the last fee we need to talk about are platform fees. These are commissions and other fees that the brokerage firm where your money is custodied charges. According to Michael, the average platform fee is 0.20%. Note that it could be a much lower than that today but that depends on what the financial advisors are investing in.

So, if we add all the fees we have discussed so far, an investor’s costs with an advisor could be over 2% of their portfolio per year.

WealthArch Fees

At WealthArch, we do not charge financial planning fees for our clients who meet our minimum requirements. An overwhelming majority of our clients are invested in individual stocks, so these clients normally do not have any underlying investment fees compared to those advisors who invest in funds that we talked about earlier. Once in a while, for some clients, we may purchase an ETF or two, but it’s rare and the position size for those funds isn’t large. Plus, we usually don’t own them for very long.

Most of our clients only pay all-in fees of around 1.02% per year vs. over 2% with other advisors.

There are only 2 fees that most of our clients pay. The first is our investment management fee, which is 0.25% per quarter (1% per year). The second is commission charges from the brokerage firm we use (Interactive Brokers) for stock trades. Since we do block orders, the fee per account per trade is usually less than $1. Because we are long-term investors, we don’t trade that much, so an $80 annual cost in commissions would rarely happen. It may, however, happen in a new client’s first year when we have to establish their initial investment positions. So, if we take $80 divided by the minimum account requirement of $400,000 that comes out to 0.02% and we think it is less than that for most years.

Cost vs. Value

Costs are only one side of the equation. What value are you getting for the fees you are paying?

At WealthArch, we offer unique benefits to our clients. You can read more about them here.

If you’ve read the page that lists our unique value proposition, you can see that not only are you paying less compared to hiring someone else, you are also getting much more value.

We feel that hiring us is like buying a Lexus but paying a Toyota Corolla price tag.

Choosing a financial advisor is a significant decision that can greatly impact your financial future. We hope that you give us a chance to help you achieve your goals. Please contact us to schedule a complimentary consultation.

Please let me know if you have any questions or comments.

Please feel free to share our post!

Earl Yaokasin, CFA, is an investment manager who runs WealthArch Investment Services in Pasadena, CA. He is a fiduciary with over twenty years of experience, and whose entire personal portfolio is managed by the firm in the same investments as the company’s clients. His firm focuses on value investing, similar to Warren Buffet’s successful approach, and disciplined strategies designed to create growth with downside protection, enabling clients to move steadily towards their life goals and aspirations with confidence.