WealthArch vs. Index Funds

What are Index Funds?

Over the last decade or so, index funds (also called passive funds) have grown in popularity. Index funds are a type of mutual fund that is composed of stocks that mirror a financial market like the S&P500. Their popularity is well deserved, because these funds charge very low fees and have outperformed most actively managed funds since 2009. Actively managed funds are portfolios constructed and directly managed by a fund manager or financial advisor, such as WealthArch Investment Services.

Despite that, there is a sea change that is occurring. Inflation and interest rates are finally on the rise after being abnormally low since late 2008. While fiscal stimulus has continued until today, past monetary stimulus is being reversed slowly towards historical norms.

This new landscape likely increases the possibility that active managers will do better over the next decade compared to the last decade.

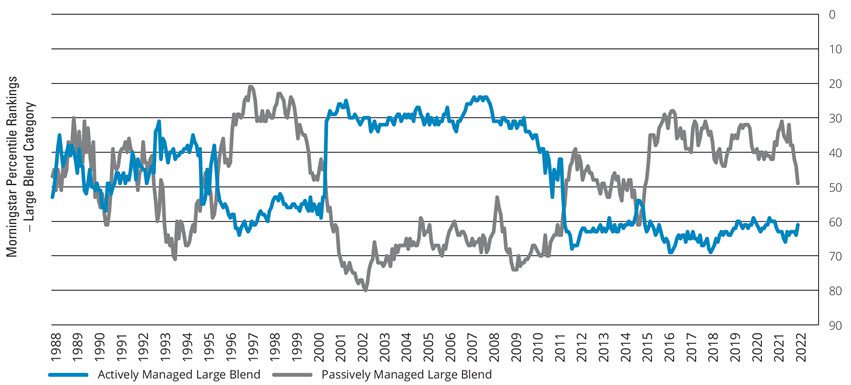

Exhibit 1

Index Funds Have a Momentum Strategy

The most popular index funds are market-weighted. That means index funds own more stocks that have gone up value.

To simplify this concept, let’s pretend that we were creating a 2-stock index fund starting with an equal amount of $100.

If stock A doubles and stock B remains the same, you’ll have $200 in stock A and $100 in stock B.

Exhibit 2

| At Inception | At Inception | After Stock A Doubles | After Stock A Doubles | |

|---|---|---|---|---|

| Stock A | $100 | 50% | $200 | 67% |

| Stock B | $100 | 50% | $100 | 33% |

| TOTAL | $200 | 100% | $300 | 100% |

In this example, investors in this 2-stock index fund would therefore own a higher % of stock A than stock B compared to when the index was created.

As a result, if you blindly add money regularly to index funds when stocks are trending upward, then you are buying more and more of the stocks that have gone up.

This momentum strategy is great when stocks are steadily going up just like it did from 2009-2021, but what happens if stocks enter a bear market?

No one knows for sure, but if the momentum shifts, we could see index funds underperforming many active managers as we have seen in Exhibit 1.

Index Funds Don’t Have Downside Protection

I’ve met people who told me that their primary reason for investing in an index fund is because they think it is “safe”.

They forget or are unaware that the S&P500 index was down around 40% in 2008 and down around 20% in 2022.

Index funds have low fees, but they are not “safe”. Investors in index funds are not protected from market risk, primarily because they are always fully invested.

On the other hand, a few active managers, like WealthArch, aren’t afraid to keep cash on standby when the markets are expensive.

Index Funds are Robotic

As mentioned earlier, the most popular index funds are market-weighted. The S&P500 is comprised of the largest 500 companies by market cap in the US.

This means that S&P500 investors own all these 500 companies regardless if they are overvalued, facing secular headwinds, poor management, etc.

In other words, because an index fund follows a formula with minimal intervention, the fund will own some good and some bad investments.

Some active managers, like WealthArch, are able to position their client portfolios overweighed towards defensive and undervalued investments, so even when a large correction happens, their stocks overall lose less than the index funds.

The Average Person Buys In and Sells Out of Funds at the Wrong Time

Most investors chase the stock market when it’s hot and panic when the market declines. Because most people incorrectly time the market, they earn a significantly lower return than both index funds and actively managed mutual funds.

Exhibit 3

Conclusion

At WealthArch, we have the opposite of a momentum strategy. We always aim to be greedy when the markets are fearful, and fearful when the markets are greedy. In other words, buy low and sell high.

We conduct in-depth investment research to invest in companies that have attractive risk/reward propositions (click here to learn more) and avoid poor ones.

Because of our value investing philosophy (click here to learn more), we require a margin of safety or buffer that helps reduce the risk of permanent loss.

Finally, we help our clients avoid panicking when the markets go down. In fact, we educate and encourage them to be aggressive; because this is when the best risk-adjusted investments are made.

Please let me know if you have any questions or comments.

Please feel free to share our post!

Earl Yaokasin, CFA, is an investment manager who runs WealthArch Investment Services in Pasadena, CA. He is a fiduciary with over twenty years of experience, and whose entire personal portfolio is managed by the firm in the same investments as the company’s clients. His firm focuses on value investing, similar to Warren Buffet’s successful approach, and disciplined strategies designed to create growth with downside protection, enabling clients to move steadily towards their life goals and aspirations with confidence.